Configuring Expense Categories Follow

While Tallie is able to sync your Chart of Accounts from your accounting software (listed under Manage Lists > Accounts), this list is not visible to expense submitters since it may reveal too much information in regards to your accounting.

For QuickBooks Desktop, QuickBooks Online, BILL, Xero, and standalone users, you will need to create Expense Categories in Tallie, which are mapped to an appropriate expense account or service item of your choice. They can also be mapped to Non-Inventory Part Items and Other Charge Items. When users create expenses, there will be a drop-down menu to select from a list of Expense Categories.

For Intacct users who are subscribed to Intacct’s Time & Expense module and have Expense Types enabled, the Expense Categories list is the newest dimension that can be synced with Intacct. With our activity-based sync, any new Expense Type created in Intacct will be synced to Tallie with its expense account readily-mapped. Likewise, an Expense Category created in Tallie will also be reflected as a new Expense Type in Intacct.

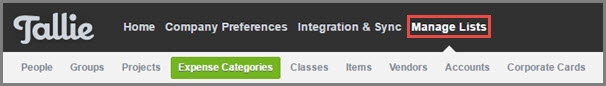

To configure Expense Categories:

- Click on the gear icon in the upper right

- Click on the Manage Lists tab

- Click on Expense Categories

- By default, Tallie already has several recommended expense categories available for use. If you aren’t going to use some of them, you can archive them by hovering over the line, clicking on the blue arrow on the right, and selecting Archive.

- To add a new category, click Add Expense Category. You may also click on a category to edit it.

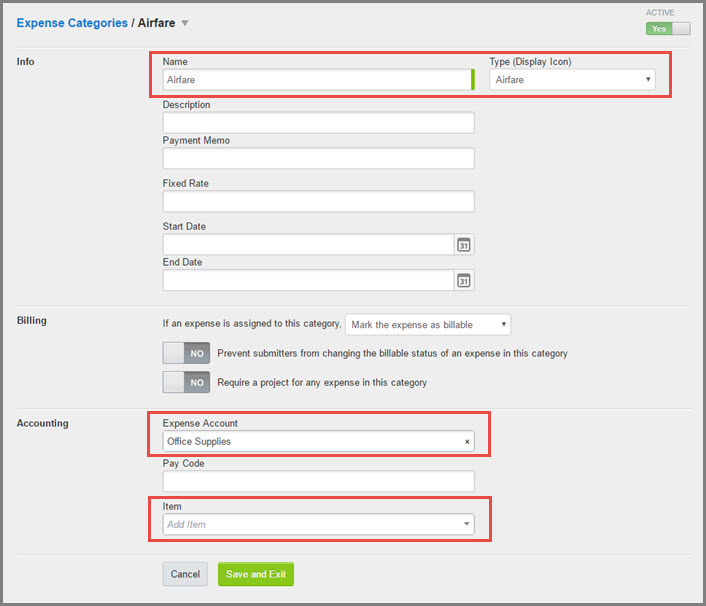

Category Name & Type:

- When creating or editing an expense category, enter the Name and select the Type (Display icon). While most are basic types, there are three special types including Entertainment, Meals, and Mileage.

- If a user selects a category with Entertainment or Meals type, Tallie will reveal another field called "Attendees" on the expense transaction where he/she can enter names of people involved.

- All Mileage type expense categories will be available when users enter mileage expenses.

- See Customizing Payment Memo for Payment Memo instructions.

Fix Rate

- This field may be utilized if you have a Per Diem type of expense.

- The default Mileage categories have a predetermined fixed rate per mile – these rates are the standard rate set by the IRS for the respective years.

- Start Date & End Date are optional. These will restrict when people can select this expense category.

Billable Status

- You're able to set both the billable status and whether a project needs to be set.

- You can set the Expense Category to not change the billable status, to mark the expense as billable or non-billable. In both cases you can also force the setting by checking Prevent submitters from changing the billable status of an expense in this category.

Expense Account or Item

- If you will be exporting expenses out of Tallie to other integrated software such as QuickBooks or BILL, you should map your expense category to either an Account OR a Service Item.

- Some account types that can be mapped are Expense, Cost of Goods Sold, Other Current Assets, and Fixed Assets.

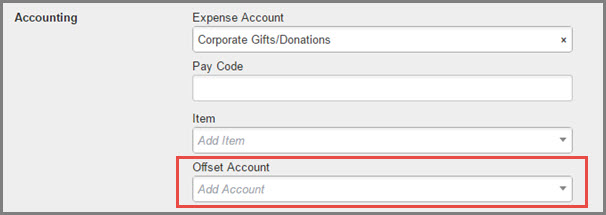

Offset Account (Intacct only)

- Individual expense types in Intacct can be assigned unique offset accounts that will override that default setting when expense reports are created in Intacct. To honor this setting, Tallie now has the flexibility of assigning custom offset account as well. Please note that this is an Intacct Time & Expense-exclusive setting and all expenses exported to Accounts Payable and Cash Management will continue to be offset by your default payable account(s) as configured in Intacct.

Please Note: You may map several expense categories to a single expense account or item, but you cannot map a single expense category to several accounts or items. In those cases, create additional expense categories and map them accordingly.