Exporting Non-Reimbursable Expenses to QuickBooks Bank Accounts Follow

Debit card, bank account transactions and/or PEX card integration can now export to Quickbooks Desktop bank accounts similar to the functionality for Quickbooks Online. This article will show you how to configure Tallie to export to a QuickBooks Desktop bank account.

Configure Tallie to Export to Quickbooks Desktop Bank Account

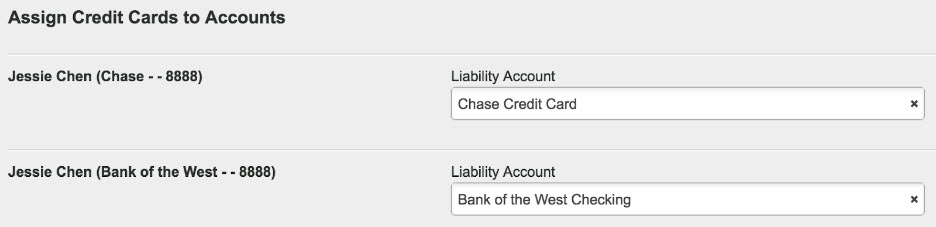

Navigate to Settings > Manage Lists > Corporate Cards > map a corporate card to a Bank account > Save changes.

Please Note: Non-reimbursable charge (positive amount) export generates a check, while non-reimbursable credit (negative amount) export generates a deposit on the account mapped on the Corporate Cards page.

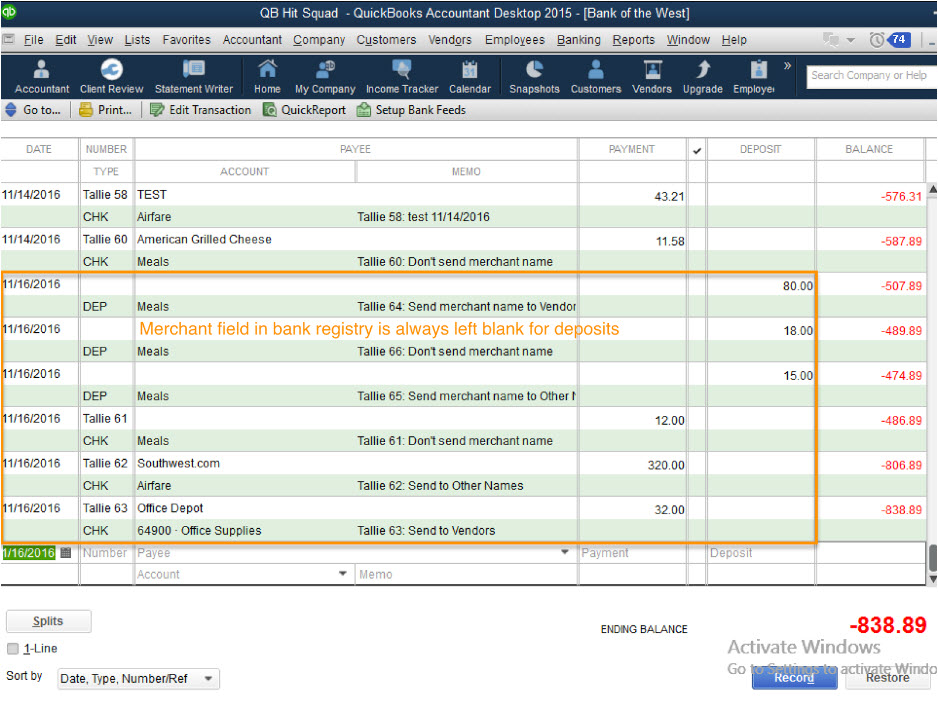

Send Merchant Name to Accounting

When “Send merchant name to accounting” is unchecked, we do not send merchant name and leave payee field blank. If “Send merchant name to accounting” is checked, we send merchant names to the list that has been chosen on that setting (either Vendors or Other Names) and populate it in the payee field of the check or deposit entry.

Navigate to Settings > Integration & Sync > Export Settings > check/uncheck the Send merchant name to accounting box > Save changes.

Please Note: For deposits, this setting controls the Received from field in the deposits edit view. Deposits’ Payee field in Bank Registry is always left blank.

Exported Data in Quickbooks Desktop

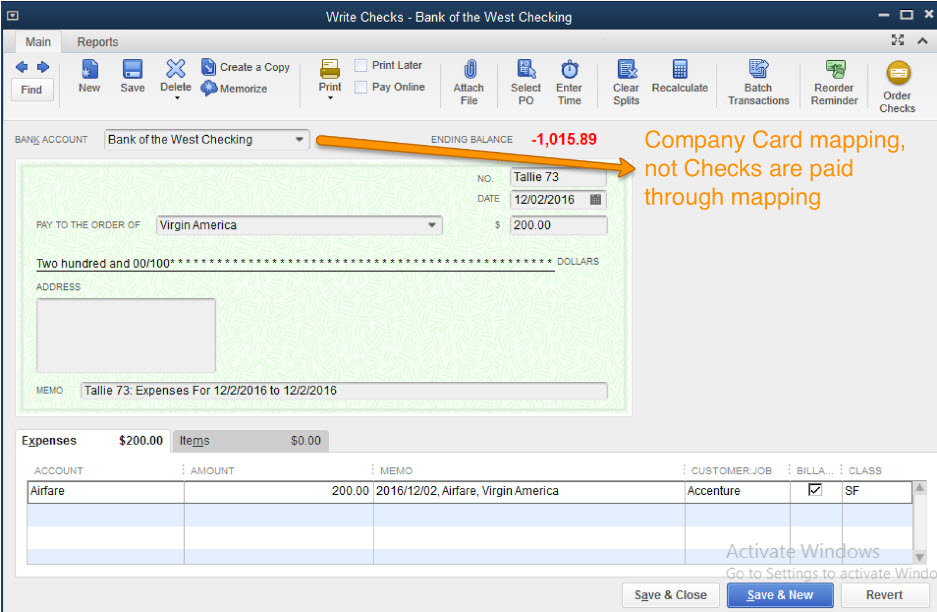

Sample check:

The Bank Account selected refers to the mapping in the Corporate Cards page and not the Checks are paid through mapping in the Export Settings page.

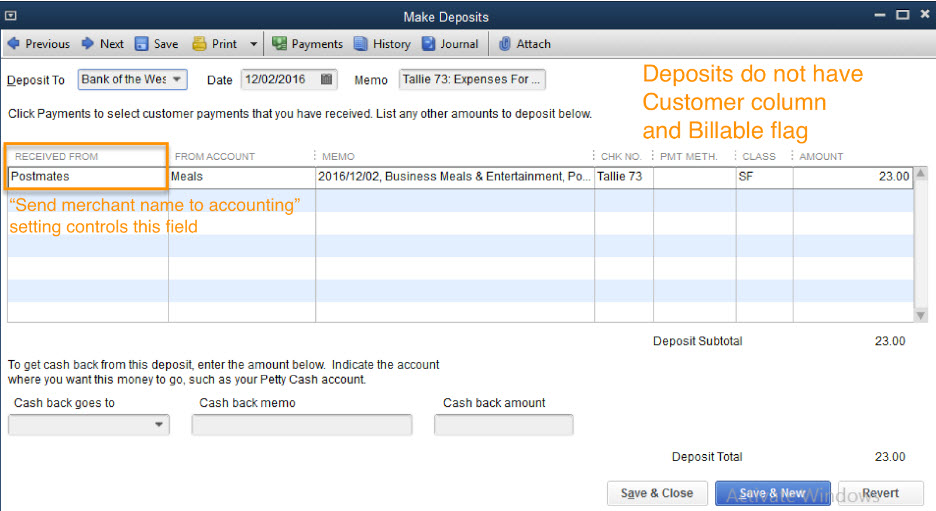

Sample deposit:

The Received From column in Quickbooks comes from the Send merchant name to accounting feature in Tallie. When sending as deposits, the Customer and Billable flag columns are removed in Quickbooks.